Trump’s Ceasefire Impact: On 24th of June 2025 U.S. President Donald Trump proclaimed the start of a “complete and total ceasefire” between Israel and Iran, to be rolled out in a staggered manner. Israel had already largely accepted to halt, after a military campaign that saw the destruction of several Iranian targets. Israel reportedly received the message from Iran, a final though unrequited receipt of an Iranian last-minute volley of missile strikes immediately before the ceasefire took hold.

Trump’s Ceasefire Impact Globally & Risk-On Sentiment

Oil Market Response

The announcement caused an immediate and dramatic drop in oil prices. Brent crude price dropped more than 9 percent over two days, settling down in the $67–70 a barrel range levels not seen since early June. This decrease relieved inflation worries associated with energy and eliminated the threat of a closure of the Strait of Hormuz.

Capital Markets

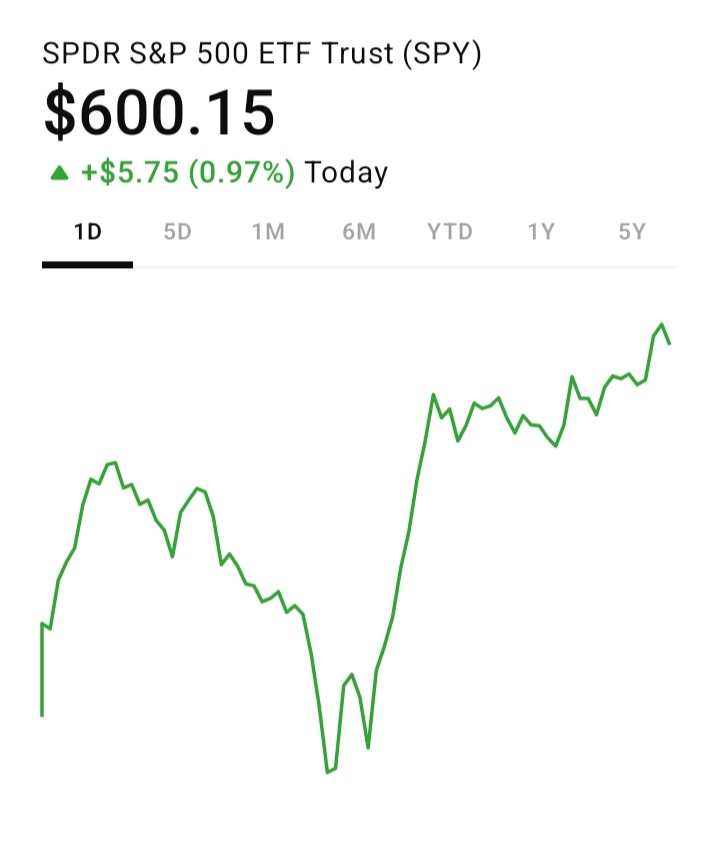

Stocks skyrocketed around the world. Wall Street futures climbed roughly 1%; the S&P 500 and Dow Jones rose by about 1% on the day . In Asia, Japan’s Nikkei (+1.3 %), Hong Kong’s Hang Seng (+1.8 %), and South Korea’s Kospi (+2.8 %) were all up big. European markets largely mirrored this trend, and gold fell more than 1% to a two-week low as safe-haven demand diminished.

Currency and Bond Markets Reaction

The U.S. dollar weakened. The Dollar Index was down roughly 0.6% on Fed-cut expectations, with the potential first cuts coming as early as July. Treasury yields moved modestly lower, with the 10‑year settling in a target range of ~4.33–4.35%.

In today’s online world, that means algorithmically, oftentimes through a process called “natural language processing.”

Crypto Funds Record $2 Billion Inflows After Trump’s Pro-Crypto Order

Trump’s Ceasefire Impact on India

Equities

India’s own domestic markets followed the same trend, reflecting the global sentiment:

The Nifty 50 blasted through 25,200 levels, up almost a percent in early trade.

The Sensex jumped upwards of 900–1,100 points, raising India’s market capitalization by about ₹5 lakh crore.

Oil-import sensitive sectors (IOCL, BPCL, InterGlobe Aviation) at 2–4% gains as opposed to upstream players (ONGC, Oil India) which fell on falling oil.

Rupee Appreciation & Macro Impact

Meanwhile, the rupee appreciated as well, trading at an improved value of around ₹86.2/US$, beating forward contracts and supported by falling oil prices. This relieves imported inflation pressure on India and bolsters India’s fiscal and monetary space.

Trade & Freight Concerns

Even with the ceasefire, short and long-range missile attacks between Iran and Israel continued, introducing unpredictability into Indian shipping lanes. Freight costs have skyrocketed by 20–50% in some instances, delaying shipments and increasing trader stress.

Outlook & Key Risks

Easing of crude inflation and geopolitical tensions should support both global and Indian equities. Rupee stabilisation and a reversal in energy inflation may allow the RBI towards keeping policy more supportive.

Though passage of the IIJA was historic and groundbreaking, there are lingering concerns which executive orders and other federal actions cannot address alone.

This ceasefire can be partial and very fragile, with ongoing exchanges of fire. In particular, disruptions in shipping activity and persistently high freight rates may threaten sectors dependent on exports.

“CONGRATULATIONS TO EVERYONE! It has been fully agreed by and between Israel and Iran that there will be a Complete and Total CEASEFIRE…” –President Donald J. Trump pic.twitter.com/hLTBT34KnG

— The White House (@WhiteHouse) June 23, 2025

U.S.–India tariff negotiations set to begin in July. Re-invigorated protectionist measures might sour mood. It would require climate impacts to be considered in review processes for major infrastructure and transportation projects.

Market Snapshot

The SPDR S&P 500 ETF (SPY) is trading around $600, fuelled by global risk-on momentum and dovish Fed expectations. Indian indices are on a parallel upward track, lifted by the positive sentiment and local macro tailwinds.

Trump-mediated ceasefire between Israel and Iran causes immediate risk-on rally with oil prices, dollar going down and equities globally and in India soaring. In India, the rally is further magnified by gains in the rupee and easing on inflation. Ongoing regional instability and inflationary pressure on freight may offset improvements. Ceasefire durability, U.S. trade policy initiatives, and central bank communications across the world are three key issues investors should watch.