AI Based Death Clock: Imagine knowing the approximate day you might die not from superstition, but from artificial intelligence. By analyzing your lifestyle, health data, and environment. This is the premise behind emerging AI-based “death clocks,” like the recently launched Death Clock app. It combines data science with mortality research to predict users’ life expectancy. While it may sound like a gimmick, the implications are profound. From reshaping personal financial planning to influencing global insurance models, consumer behavior, and healthcare investment strategies, this technology is poised to become more than just a digital curiosity. But with innovation comes risk raising ethical, economic, and regulatory questions that the world must now confront.

How AI Based Death Clock Might Influence Global Market?

Disruption to Financial Planning & Markets

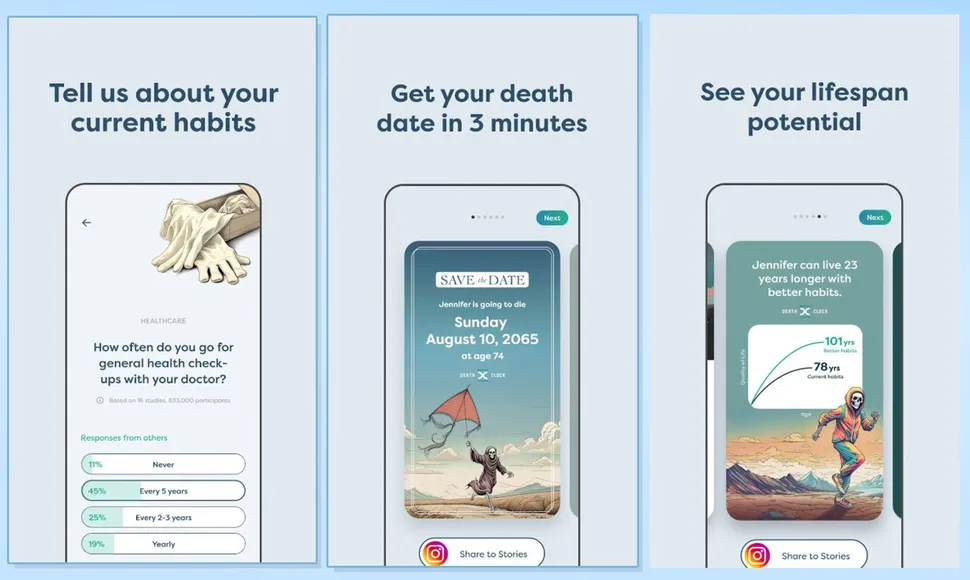

A new type of AI-driven death‑prediction apps, such as Death Clock, which went live in July 2024 and relies on artificial intelligence that drew knowledge from 1,200+ life‑expectancy studies involving ~53 million people, are taking off which have more than 125,000 downloads already. These online tools provide customized life-span estimates articulated according to inputs on lifestyle choices and health factors, skipping over the one-size-fits-all actuarial tables.

For retirees and financial planners, this translates to more accurate life expectancy predictions. As Ryan Zabrowski, a CFP®, explains, another major fear during retirement is outliving one’s savings after death. A more defined life expectancy can help to improve savings levels, withdrawal rates and portfolio performance. Insurers, pension funds, and governments (e.g., Social Security systems) could recalculate their life‑expectancy assumptions, influencing controls on solvency strategies, premiums, and public finance allocations.

For users of the AI-powered Death Clock app, which costs $40 annually, the tool offers personalized lifestyle recommendations to extend life expectancy while displaying a countdown of estimated remaining time. “There’s likely not a more critical date in your life than the date that you’re going to die,” says developer Brent Franson, driving home the app’s goal of helping users identify tangible and meaningful improvements.

Longer, newly predicted lifespans will need great savings that retirees will wish to spend and probably will need to move investments in the direction of high-growth (equity) property, doubtlessly tipping market demand away from bonds.

Bitcoin Drop Amid AI Sector Shakeup: Impact on Crypto Market Rally

Socio‑economic Equity & Bias Risks

Additionally, machine learning to develop AI models that can estimate mortality based on socio‑economic, demographic and lifestyle factors. Research shows that higher income people tend to live about a decade to decade and a half longer than those with lower incomes. As useful as these AI tools can be for illuminating such disparities, they risk reinforcing them. The people who are able to afford healthier lifestyles or premium subscriptions (such as Death Clock’s $40/year plan) get a survival advantage.

Models are also subject to bias, particularly if training datasets do not include the range of socio-economic status or environmental elements (e.g., pollution, proximity to industrial areas). This may result in discriminatory insurance rates or adverse action in credit, housing, or employment against individuals or groups with certain longevity profiles, inviting regulatory risks.

Psychological & Consumer Behavior Impacts

Showing people their estimated “date of death” could increase death salience, motivating users to make positive lifestyle changes such as improving nutritional intake or starting an exercise program. It can heighten anxiety or depression in susceptible people and bias choices if these forecasts are presented as firm certainties.

From a business model standpoint, greater longevity would undoubtedly lead to booms in demand for health technology (wearables, telehealth), wellness products, preventative medicine, and aging-ameliorating pharmaceuticals, uncovering new battlegrounds for investment.

Ethical, Regulatory & Data Privacy Concerns

These apps have access to a great deal of sensitive personal and health information. Death Clock, for example, permits users to enter more extensive lifestyle information in exchange for a paid subscription, setting off privacy alarm bells. Harms from data sharing Policies around sharing user data, especially with third-party partners, may put users at risk of a data breach or data misuse, prompting regulatory scrutiny in jurisdictions such as the European Union or India.

Moreover, these pitfalls are troublingly ubiquitous with health‑care AI tools ethically with consent, fairness, transparency, and clinical validity being of major concern. Future market trust stands to take a hit if these frameworks fail.

Global Economic & Public Policy Effects

Accurate, individualized predictions of longevity could fundamentally change how governments, insurance agencies, and healthcare systems invest their resources. This might mean governments need to invest in medical infrastructure designed to support aging populations or taxpayers need to invest in new, younger workforces through changing pension ages and tax structures.

They additionally set the stage for major academic discussions such as those published by the National Bureau of Economic Research, calling for us to shatter the age‑based framework and assess functionality in policy design.

AI-based death‑prediction tools such as Death Clock are fundamentally reframing personal and societal understanding of longevity. Their implications go well beyond just morbid curiosities. They have much to gain in revolutionizing financial planning, insurance underwriting, socio-economic equity, healthcare innovation, and regulatory oversight worldwide.

Only if we implement strict ethical oversight, bias prevention, and clear laws will they be truly transformative. Of course, for avoiding the erosion of public trust and protecting m